ES Futures Tick Value: Explained with Examples

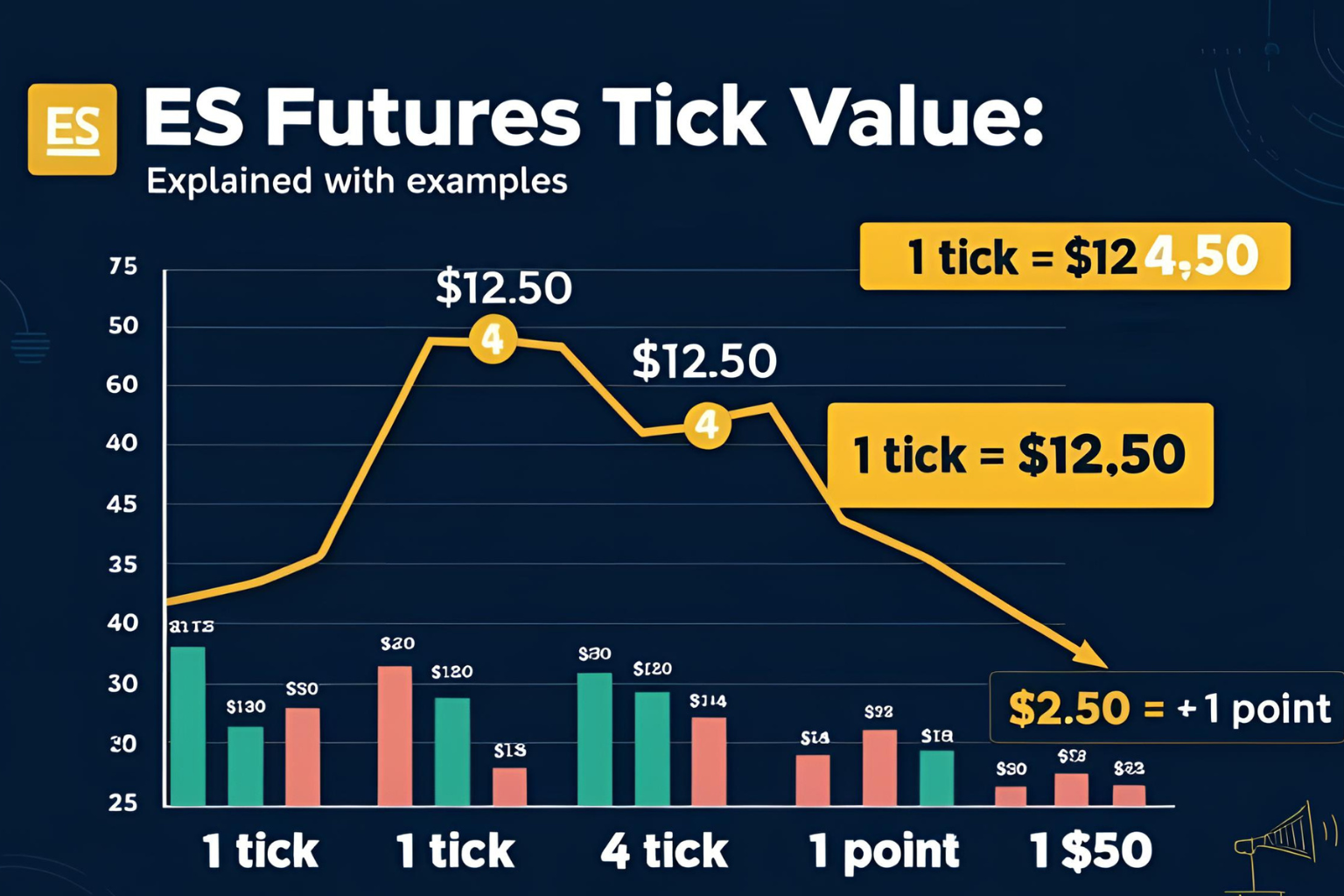

If you’re trading ES futures (E-mini S&P 500), understanding tick value is crucial. Every price movement—no matter how small—can impact your trade outcome. This article explains what a tick is, how much it’s worth, and how to calculate gains or losses based on tick movement.

What Is a Tick in ES Futures?

In futures trading, a tick is the smallest possible price movement a contract can make.

- For ES futures, the tick size is 0.25 index points.

- Each tick is worth $12.50 per contract.

✅ 1 full index point = 4 ticks = $50 per contract

ES Futures Tick Value Breakdown

| Movement | Ticks | Value (1 Contract) |

|---|---|---|

| 0.25 (1 tick) | 1 | $12.50 |

| 0.50 | 2 | $25.00 |

| 1.00 | 4 | $50.00 |

| 2.00 | 8 | $100.00 |

| 5.00 | 20 | $250.00 |

If you trade 2 contracts, simply double the tick value. For example, 1-point move = $100 (2 × $50).

Real Example: Tick Movement Profit

Let’s say you enter a long trade at 4,800.00 and exit at 4,802.00.

- That’s a 2-point move, or 8 ticks.

- Profit = 8 ticks × $12.50 = $100 per contract

If you traded 3 contracts:

- $100 × 3 = $300 profit

Tick Value vs Tick Size

- Tick size: The minimum price increment (0.25 points)

- Tick value: The dollar value of that increment ($12.50)

They’re related but not the same. Tick size is about price; tick value is about money.

Why Tick Value Matters

- Defines reward and risk

- Helps with position sizing

- Essential for calculating profit/loss

- Impacts scalping and intraday strategies

Micro ES (MES) vs ES Tick Value

| Contract | Tick Size | Tick Value |

|---|---|---|

| ES | 0.25 | $12.50 |

| MES | 0.25 | $1.25 |

MES is great for beginners due to lower exposure.

Using Tick Value in Strategy

- Set stop-loss and targets using ticks

Example: 4-tick stop-loss = $50 risk per contract - Scalpers often aim for 2–4 tick profits

- Swing traders may target 20+ ticks

FAQs

Q1. What is 1 tick worth in ES futures?

$12.50 per contract.

Q2. How many ticks make up 1 index point?

4 ticks (0.25 × 4 = 1.00 point)

Q3. Can I adjust tick size?

No. Tick size is standardized by the CME.

Q4. Is tick value different across brokers?

No. Tick value is defined by the contract, not the broker.

Q5. What’s better for small accounts—ES or MES?

MES, as its tick value is just $1.25, offering more flexible risk control.